Wellness Hotels for Every Traveler: Trends Reshaping Hospitality

Hotels are capturing a larger share of the wellness hospitality market by catering to travelers seeking accommodations that emphasise authenticity, sustainability, and value for money.

The world of travel is changing rapidly, with travelers increasingly seeking more than just a place to stay. Instead, they are seeking holistic experiences that nurture their bodies and minds.

This marks a significant shift in the hospitality market worldwide—hotels increasingly transform themselves into sanctuaries where guests can indulge in their physical and mental well-being. This poses a significant question: How do hotels gain a competitive edge in the evolving wellness hospitality landscape?

In recent years, wellness tourism has transitioned from a niche luxury trend to a mainstream movement. Wellness hotels, which integrate health-oriented amenities and packages into their offerings, are significant players in this evolution. These changes in the hospitality landscape pose new complexities but also intriguing opportunities.

Rise of Wellness-Driven Travel: Shifts in the Hospitality Landscape

Wellness tourism has emerged as one of the leading trends shaping the hospitality industry, according to data from EHL Insights. It’s a trend catalyzed by the pandemic, which has reshaped traveler priorities and introduced new demographics of consumers seeking vacations that support their health and wellbeing needs.

For some, this means staying healthy while traveling through fitness-friendly and nutritious options. For others, wellness travel is viewed as a deeper and more meaningful investment in their long-term mental, physical, and emotional wellbeing.

As wellness-driven travel is here to stay, hotels have capitalised on the trend and weaved wellness into their operations. This includes not only promoting existing amenities but also making strategic investments in new offerings and experiences to stay competitive:

- Marketing of wellness-related amenities: Many hotels already have amenities such as fitness centers and pools, which can be strategically marketed as wellness features.

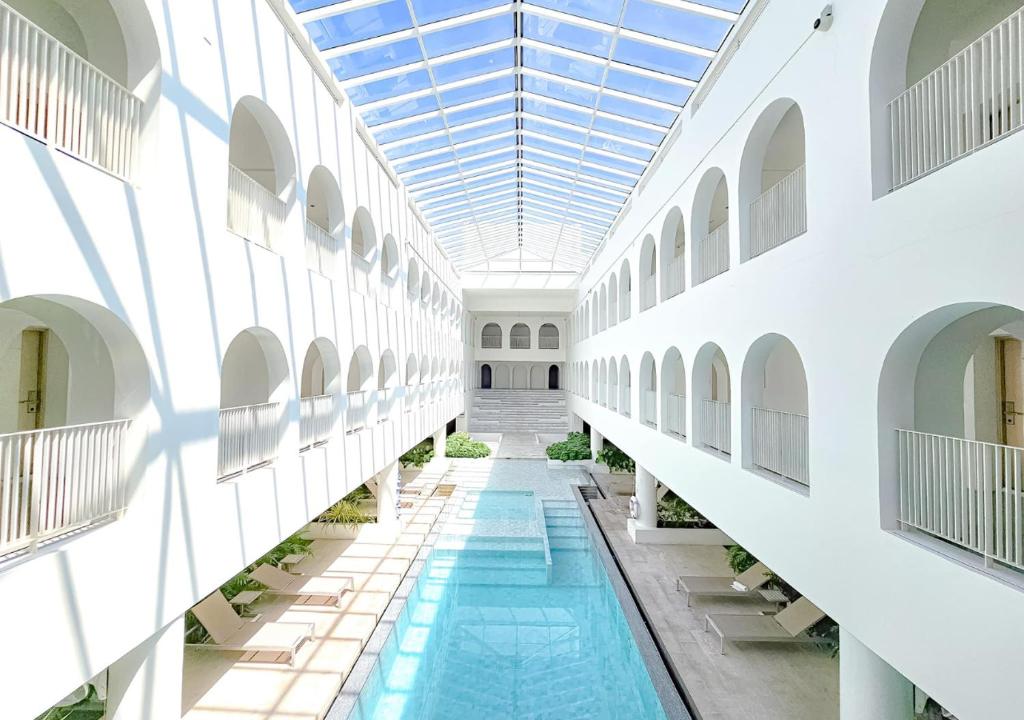

- Renovation and remodeling: Hotels are redesigning spaces to prioritise wellness, with biophilic design—the practice of bringing nature indoors—being a growing trend. Such remodels may incorporate features that imitate natural environments, such as water fountains, skylight installations, and indoor gardens.

- New amenities: From infrared saunas to sleep optimisation rooms equipped with blackout curtains and air purifiers, hotels may introduce new amenities catering to varying levels of technological sophistication.

- New products and services: To diversify their offerings, many hotels provide curated wellness packages that include spa treatments, yoga classes, and healthy dining options.

When launching new initiatives, hotels may partner with local farms and chefs to offer farm-to-table dining options or engage massage therapists for personalised in-room services. These strategic partnerships can foster authentic, locally inspired experiences that align with sustainability standards. On a wider scale, hotels partner with wellness brands, enhancing the guest experience through in-room offerings such as aromatherapy kits and luxury bath products.

Often, such initiatives are highly profitable. Wellness packages, for instance, bundle accommodations with curated experiences such as meals, fitness programs, and spa treatments to create immersive and personalised experiences. They offer guests a sense of transformation that goes beyond a typical hotel stay.

As a result, wellness-oriented packages often boost the hotel’s average daily revenue by attracting premium-paying guests. They also drive longer stays (often incentivised by discounts) and guest loyalty through repeat visits. In many cases, wellness packages serve as a cheat code for boosting year-round occupancy rates of hotels, effectively smoothing out the dips of low seasons.

Wellness Hotels for Every Traveler

Historically, wellness tourism tends to be more exclusive to affluent travelers. Many luxury wellness resorts provide premium amenities like private villas and specialised wellness programs. Beyond such accommodations, high-end travelers also seek indulgent experiences in private wellness retreats and luxury spas.

Yet, in recent times, wellness-driven travel is increasingly sought after by a broader demographic. With options ranging from premium to budget-friendly stays, wellness-oriented hotels are responding to changing consumer demands.

While luxury establishments provide med spas and bespoke wellness retreats, mid-range properties may offer basic yoga classes and nature-inspired designs. Although experiences are tiered by price, personalised wellness services and programs are increasingly embraced by mid-range and even budget hotels worldwide.

Hotel Wellness Features for Non-Luxury Travelers:

- Fitness Amenities: Basic gyms and swimming pools.

- Fitness Classes: Yoga, aerobics, or beginner-friendly group sessions.

- Healthy Onsite Restaurants: Reasonably affordable menus with local, organic ingredients.

- Massages: Affordable, simple treatments like Swedish or foot massages.

- Nature-First Designs: Rooftop gardens or indoor plants to create calming environments.

- In-Room Wellness Features: Basic offerings like yoga mats and comfortable bedding.

- Wellness Workshops: Budget-friendly mindfulness programs or simple activities like journaling workshops.

- Hydrotherapy: Basic hot tubs or small-scale pools.

Moreover, a recent report by Smith Travel Research shows that rising hotel prices globally have shifted traveler preferences toward more cost-effective destinations and accommodations—especially amongst younger demographics. Due to factors like inflation, travelers are increasingly mindful of their accommodation options and attempt to maximise value for money. This often results in a preference for mid-range or budget hotels, Airbnbs, and hostels.

This shift has intensified competition among Southeast Asian destinations, as wellness-seeking travelers increasingly compare options before booking. Hotels are incentivised to adapt to these changing demands to capture a large share of the wellness hospitality market.

Wellness hotels appeal to a broad spectrum of travelers, including the following groups:

- Luxury Travelers: Seeking exclusive and comprehensive wellness packages.

- Medical wellness travelers: Some guests travel specifically for medical treatments, integrating wellness tourism to enhance their recovery and overall well-being.

- Mid-Range and Budget Travelers: Prioritising health but with limited budgets, these guests compare costs across destinations to maximise value.

- Gen Z to Baby Boomers: Each age group seeks tailored offerings, from eco- friendly practices for younger travelers to therapeutic spa treatments for older generations.

- Business and Event-Based Travelers: Hotel wellness initiatives like complimentary yoga and healthy dining options enhance productivity and relaxation for professionals, especially in cities like Singapore and Bangkok.

Hotel Industry Hurdles in a Changing World

Although hotels increasingly seek to differentiate themselves through wellness offerings, many find themselves at a disadvantage. The global hospitality industry is facing a complex landscape of challenges driven by evolving traveler preferences, rising costs, diversified competition, and talent shortages.

In Southeast Asia, these challenges manifest uniquely across countries.

Higher operational costs and rising room rates are key global concerns. Singapore’s hotels contend with particularly high average daily rates, risking being outpriced by budget-friendly regional competitors. In recent years, prices have spiked due to high demand and limited room availability, driven largely by business and event travelers.

Moreover, the surge in alternative accommodations like Airbnb and serviced apartments continues to challenge traditional hotels. In Thailand and Malaysia, such options appeal to budget-conscious and long-stay travelers, pushing hotels to distinguish themselves with unique offerings.

Despite this, hotel occupancy in Thailand has rebounded to near pre-pandemic levels. This is due to high demand, causing a significant increase in average daily rates particularly for high- and mid-range hotels. On the other hand, the average daily room rates in Kuala Lumpur remain relatively low compared to its regional competitors.

As for Indonesia, its hotel industry is geographically skewed—it is heavily concentrated in key regions such as Bali, Jakarta, and Java. In fact, Bali has considered banning the construction of new hotels amid overtourism concerns, in efforts to preserve quality of tourism and cultural authenticity. Similarly, Vietnam faces challenges with hotel overdevelopment which has led to low occupancy rates, underutilised properties, and financially strain across the country.

Meanwhile, the Philippines wrestles with infrastructure issues and labor shortages, as competitive overseas salaries lure skilled workers away.

Addressing these challenges requires innovative solutions. Fortunately, hotels can leverage wellness offerings to stand out while adapting to diverse traveler demographics and preferences.

The Wellness Advantage: Unlocking New Possibilities in Hospitality

Despite these challenges, wellness initiatives present significant opportunities for hotels. As the demand for wellness tourism grows, hotels across Southeast Asia are finding ways to offer wellness-integrated packages that cater to all budgets and preferences.

Lean Luxury for Business and Leisure Travelers

A response to the rising hotel prices, especially in cities like Singapore where accommodations are especially expensive, is the notion of “lean luxury”. It’s an approach championed by the Worldwide Hotels Group, which has a foothold in Singapore’s midscale hotel market. This idea is especially relevant in recent times, as Singapore’s high-end hotels continue to lead the way in hospitality innovation, creating an intriguing contrast between luxury and practicality.

Lean luxury, in contrast to extravagance and indulgence, focuses on providing essential comforts in spaces that are thoughtfully designed, efficient, and multifunctional, with an emphasis on sustainability and value.

The Mercure ICON Singapore City Centre, launched in 2024 through a franchise agreement with French multinational hospitality company Accor, demonstrates the “lean luxury” concept. It strikes a balance between affordable wellness offerings and premium service. Specifically, it provides amenities like yoga workouts and outdoor gardens without the hefty price tag associated with traditional luxury hotels.

Reportedly, all 989 rooms at Mercure ICON Singapore City Centre are carefully designed to foster both productivity and relaxation. This approach positions the hotel to capitalise on the growing trend of business-leisure travel.

By appealing to both business travelers and those looking to extend their stays for leisure, Mercure ICON efficiently captures a substantial share of the corporate market while maximising profit opportunities. By integrating functional spaces with wellness at competitive pricing, the hotel incentivises longer stays and repeat visits.

Offering wellness amenities as part of the overall package allows hotels to stand out in competitive markets like Singapore—where business travelers expect high standards but often need to control costs.

Nature-Integrated and Authentic Wellness Experiences

Many hotels in Southeast Asia are embracing the region’s natural beauty to offer wellness experiences rooted in the environment.

In the Philippines, resorts like Dusit Thani Lubi Plantation Resort and Nay Palad Hideaway harness the country’s natural beauty to create tranquil escapes, catering to both domestic and international wellness tourists.

Such destinations, offering coastal and mountain escapes, also enable tourists to indulge in Filipino wellness traditions such as traditional teas, the calming aromas of essential oils, and revitalising massages rooted in traditional techniques.

Beyond remote retreats, even urban hotels are finding ways to incorporate nature-inspired elements into their wellness offerings.

For instance, Away Bangkok Riverside Kene, a 4-star property with rates under US $70 per night, leverages its serene location by the Chao Phraya River to increase appeal. Integrating wellness with its riverside setting, its amenities include a fitness center, infinity pool, rejuvenating spa treatments, and lush gardens.

To encourage extended stays and build guest loyalty, the hotel offers discounted rates for extended stays.

These efforts not only enhance the hotel’s appeal to wellness-focused travelers, but also set the hotel apart from other mid-range properties who fail to do the same.

Policy-Driven Growth: Government Initiatives and Partnerships

The wellness hospitality landscape is complex, and hotels certainly aren’t the only players. Governments are also playing a significant role in supporting wellness tourism.

Governmental laws, initiatives, and partnerships can significantly impact their hotels’ performance.

In the Philippines, wellness tourism has been highlighted as a key growth area under the National Tourism Development Plan 2022-2028, focusing on sustainable practices and enhancing healthcare accessibility. The government recognises that wellness tourism supports a diverse range of industries—including local agriculture, artisanal crafts, and wellness-focused entrepreneurship—thus enhancing job creation and skill development in the hospitality sector.

In Vietnam, the government collaborates with local tourism associations and various partners to develop and promote wellness tourism products. The focus is on showcasing different regions by leveraging the country’s natural resources, such as beaches, islands, and mineral waters. Such initiatives can potentially benefit hotel occupancy rates across the country.

Malaysia continues to establish its reputation as a leading medical tourism destination, with its government emphasising niche wellness specialisations like fertility and oncology treatments.

Similarly, the Thai government’s recent medical visas and sports tourism initiatives bolster Thailand’s position as a wellness hub. Such initiatives improve the influx of medical tourists, creating demand for wellness-oriented accommodations.

Numerous hotels and resorts across Thailand cater to these tourists, including the Mövenpick BDMS Wellness Resort in Bangkok—a 5-star resort specialising in preventative medicine and personalised health programmes aimed at promoting longevity.

Conclusion

Wellness hotels are reshaping the hospitality landscape in Southeast Asia, offering solutions to regional challenges while catering to diverse traveler needs.

By integrating lean luxury concepts, nature-driven designs, and government-backed initiatives, hotels can create unique experiences that foster longer stays, repeat bookings, and higher occupancy rates.

Key Takeaways

Wellness tourism is evolving to cater to all budgets and demographics. Regional challenges, such as high competition, rising costs, and infrastructure gaps, are opportunities for innovative wellness solutions. Success lies in blending affordability, cultural authenticity, and sustainability.